October 29th, 2025

Happy Wednesday everyone,

Here is my attempt to share one guy’s answer to the question “what the hell is going on” in about 5 minutes.

It is more civilized to make fun of life than to bewail it.

- Seneca

The Loop

In case you missed it, Rococo Punch produced this year’s Signal Award for best documentary podcast for Charlie’s Place.

And the Pinwheel team went to New York to do the content production for the podcast track at Advertising Week.

And SBR2TH launched their AI tool for hunting talent.

And thanks to a friend of a friend with a heroic hand sanitizer facility seeking new uses post-pandemic, it looks like Doug at Merchant Boxes is going to have an American bottling facility at his disposal as outsourced management to get it humming again serving other markets.

And finally, in the spirit of Halloween, here’s Pop Ups Studio’s recent production featuring Jason:

1.6 million views in 8 days but who’s counting?

Interesting Articles / Happenings

2.a Finance

2.a.1 Obscenities as Opportunities in Markets

After five almost perfectly timed market calls over 2 years I’ve retired twice from making market predictions.

But I just can’t help sharing my two cents here to try to help you navigate these markets.

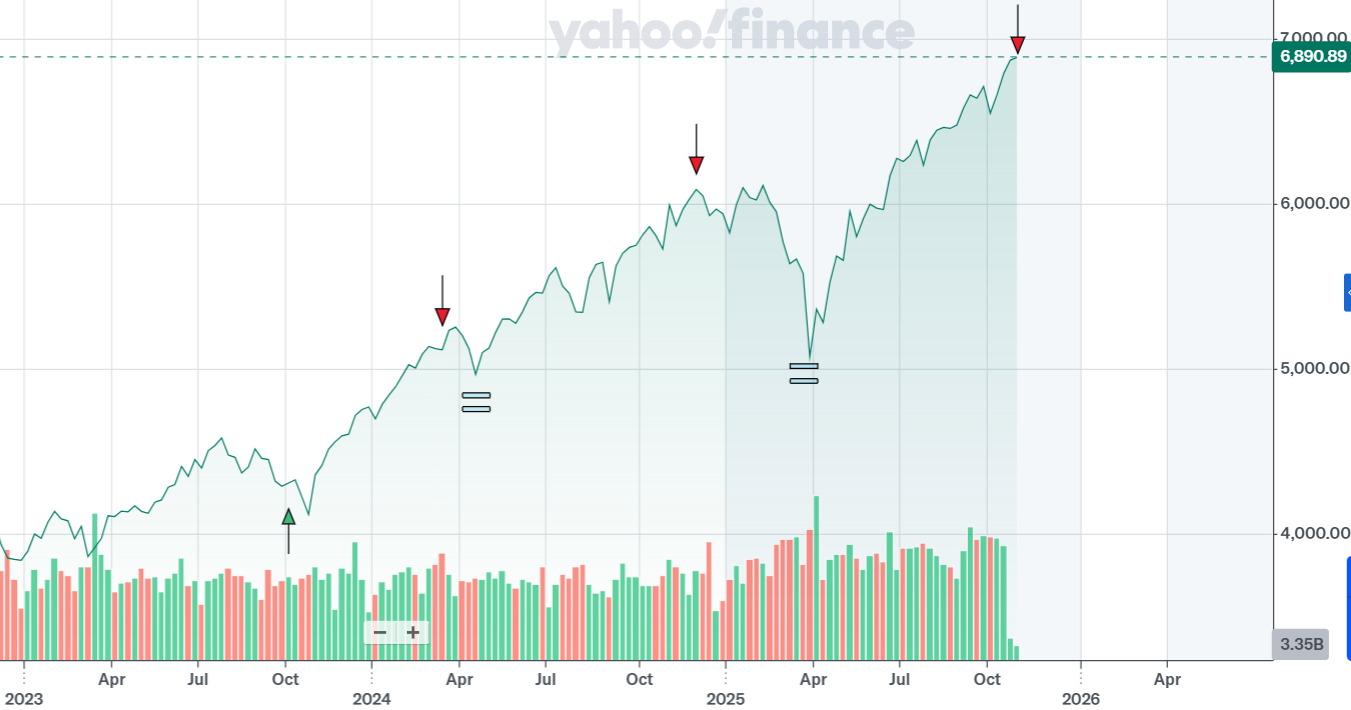

Although investing at all time stock price highs is a winning strategy over time, we are in almost uncharted territory when it comes to the valuations of public equities relative to earnings.

Price is what you pay, value is what you get.

High prices does not imply a bad purchase whatsoever, but the value to price ratio is what matters for investors.

By definition as an investor, you’re buying the cash flow stream in perpetuity of the business you’re buying, whether that’s Apple or a laundromat.

The math doesn’t lie and I’ve said before the discounted cash flow integral may look intimidating but it’s actually very simple. The present value (ie. PV) is equal to the sum from now till the cows come home (sigma n from 1 to infinity) of all future dividends (ie. D(1+g)^n) discounted by the relevant cost of capital (ie. (1+r)^n).

The way the calculus works out when you add all those future discounted dividends up is the next dividend payment D1 (or D0(1+g)) discounted by r (cost of capital) minus g (growth rate of future dividends).

One of the best short-hands to understand this price to relative earnings is the simple price to earnings or PE ratio.

A better one is Shiller PE or CAPE, which looks at long term earnings relative to price so a one-time bump in earnings for a single quarter doesn’t skew the value. Robert Shiller won the Nobel Prize for using this and other research to show that in fact, the market is not efficient (ie. making a severe dent in the Efficient Market Hypothesis which in effect has the irrational conclusion that there is not point whatsoever in determining whether any stock is a good or bad purchase).

When you evaluate the current stock market armed with this knowledge, it’s clear that we are at one of the most precipitous valuation highs we’ve ever seen.

Shiller PE is greater than 1929, 2008, and a hair away from 2000.

The market can be irrational longer than you can be liquid and although the price to earnings ratio has statistically significant predictive powers for short term performance, it is not great as a linearly regressed short-term predictor.

However, that’s not how markets work, they swing back and forth all over until it hits a breaking point and things hit the fan. There is sparse research on short-term performance using CAPE as a thresholded predictor rather than a direct correlated weighting metric (ie. for every move CAPE makes, you rebalance your portfolio). A portfolio constantly rebalancing on a linear CAPE weighing is a decent little alpha strategy, but I would not recommend making any moves as a long term investor against PE until it hits a boiling point - a threshold.

When it does, like it is now, I would do a health check on my portfolio to make sure I’m properly diversified.

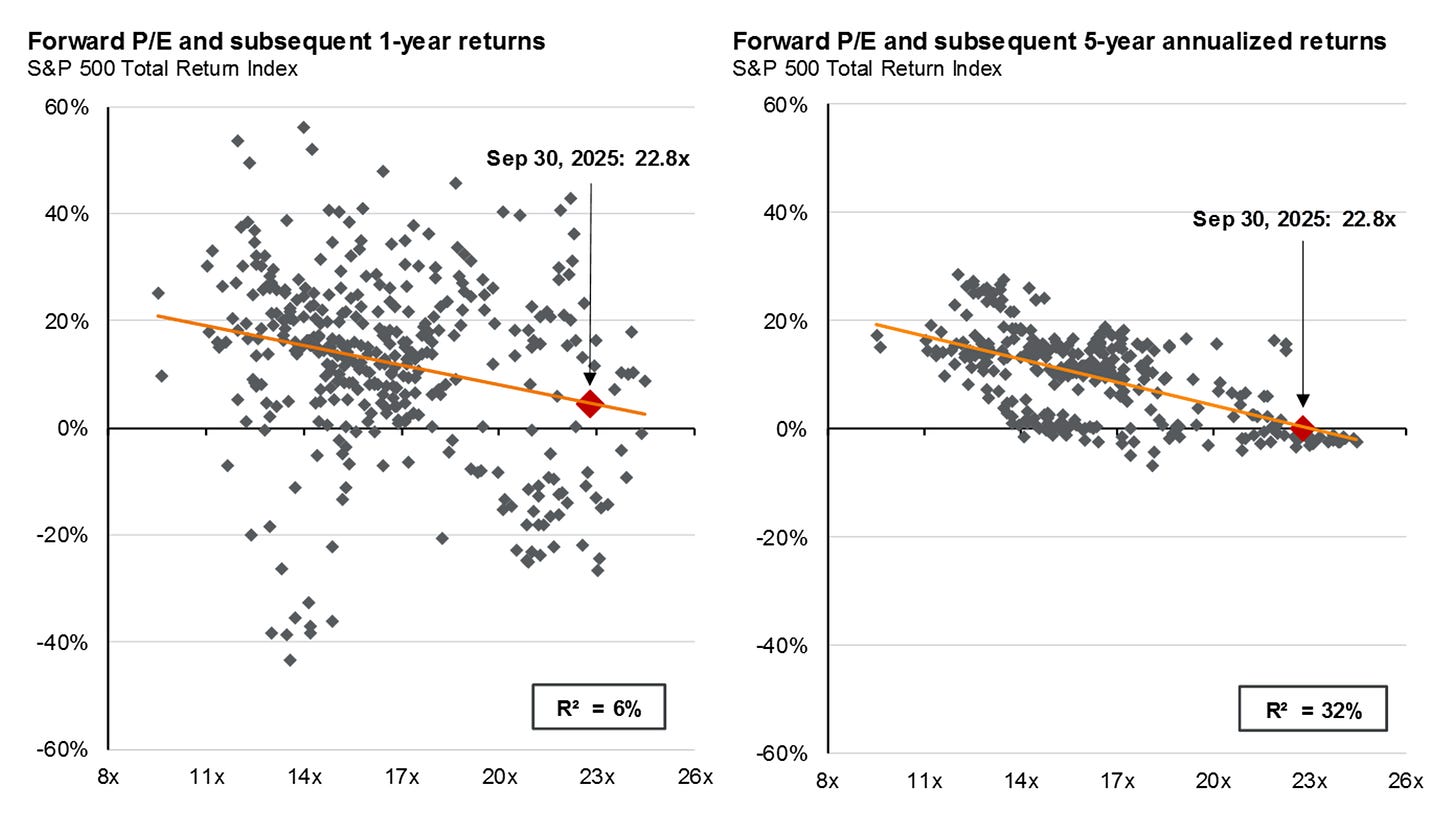

Compare the loose 1 yr regression on forward returns and the much tighter 5 yr.

Source: JPMorgan Asset Management

Notice above though, the data on 1 yr when running a linear regression is skewed to normal times when the PE ratio is moderate because of the far greater amount of data and variance there on the left side. As you get into the far right side of the graph (some analysts point to 22x forward as a useful cutoff) the dataset is more likely than not to fall on negative 1 yr returns and even more likely to fall under the 10% long run average return.

Here is the 10 yr.

Pretty damning evidence of high PE ratios killing subsequent returns.

There are a few worthy counterpoints to this.

The data is linked: For example on 10 yr cumulative returns, each data point for one year is by nature something like 90% related the next one off the bat for the 10 yr. That’s a valid statistical critique generally but in this case, long term returns are by definition linked with cumulative years so I challenge this generally valid statistical critique in this application.

This time it’s different: Some believe our big tech champions (the top 10 companies which make up about 40% of the value of the S&P 500) are way better, more resilient and diversified businesses than previous eras. It’s almost certainly not different this time. Alphabet is a phenomenal business, probably much better than Standard Oil or Enron or AIG or Bear Stearns. But so far at least, although we move the ball forward, we change the guard fairly regularly and no one has stayed on top forever.

I don’t care: I’m just trying to sell it at a higher price quickly and if the market turns I’ll be out fast. Well, God bless.

I’ll put it this way. Right now for every $100 invested in the S&P, you’re earning an average $2.43 in earnings and $1.17 in actual cash dividends.

Alternatively for private assets like the buyout deals we’re fielding for the fund, you’re looking at $15.00-25.00 in earnings annually on $100.

It’s not magic. The multiples on small businesses being in the 4-6x earnings range while publics are at 41x (31x unadjusted) is because it’s really hard. Crazy hard.

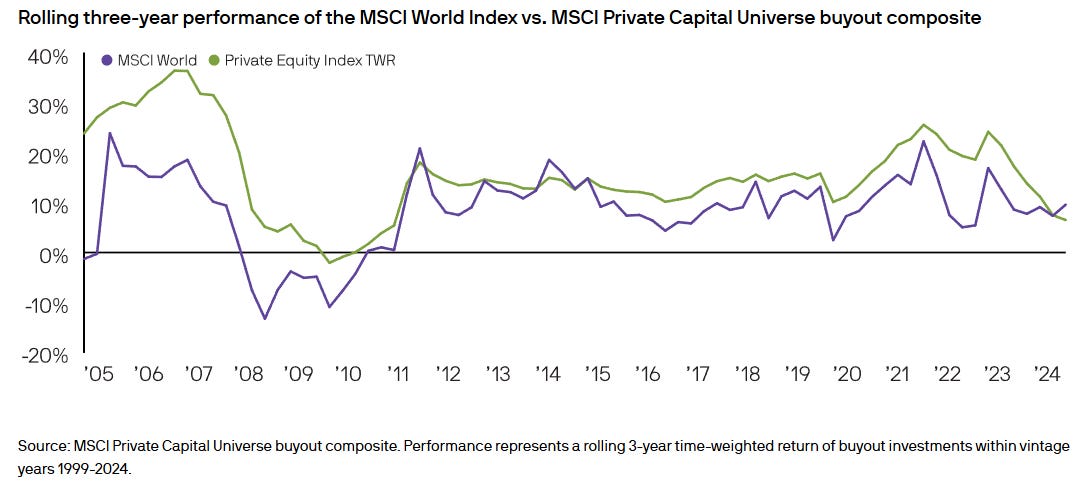

But generally, private does better.

The general lesson people draw from the story about Warren Buffet’s famous bet with Tom Seides of Protégé Partners that actively managed hedge funds would underperform low-cost index funds is that active management is a fools errand. This is a flawed conclusion may people suffer from.

Yes. When you’re competing in public stocks with an active management strategy. Absolutely not in private equity.

When you’re trying to beat the public market in the public market it’s extremely difficult. You’re betting against literally towers of buildings of MBAs sitting around applying AI and HFT to squeeze out pennies. Landscaping, bookkeeping, breweries, and assorted small businesses not so much.

Per Instititional Investor research, “Private Equity has outperformed consistently over the last 5-, 10-, 15-, 20- and 25-year periods and in 97 out of the past 100 quarters.”

That small say 2-5% outperformance annually compounds into huge, ~3x differences at retirement.

Research consistently shows a game-theoretic 15-25% exposure to private equity is generally optimal for portfolio allocation and that’s demonstrated by how large institutional investors more prone to data than emotion like insurance companies invest on the upper bound of that allocation range.

The problem is most Americans are woefully under-allocated to private equity. The data is sparse but estimates put the percentage of households that hold private equity in the single digits and generally even then under 5% portfolio allocation.

This is not a doomsday prediction, but my read on the data is that we are at the opportunity of a lifetime to diversify into the real economy.

AOC and Elizabeth Warren have valid criticisms of some of the worst offenders making obscene profits in private equity, but if social issues are a concern from missing out on higher returns, ask yourself if you’d rather hold Palantir and Meta or fund the next generation of American small business.

We launched the Co-Owner Fund to organize and capture these acquisition opportunities in a way where the employees benefit as well, in line with our purpose at nth Venture. Although I’ve repeatedly bemoaned the nearly arbitrary whims of private asset valuation, our friends at Pigeon Service recently conducted a review of every piece of equity we’ve sold (just shy of $1 million) over the last 4 years and came to 17.1% annualized performance on equity to date and 17.5% on debt, both beating comparable public performance.

There is absolutely no reason employees cannot participate as well in the upside and I would argue our promising early performance here at nth Venture is not in spite of aligned incentives via broad employee ownership - but because of it.

2.b Rest of World

The Great Filter is a term used in astronomy to describe the hypothetical obstacle or set of obstacles that may exist in the universe that prevent the emergence of intelligent, technological civilizations. The concept of the Great Filter was first proposed by philosopher and economist Robin Hanson in the 1990s as a way to explain the Fermi paradox, which asks why we have not yet observed with reliable third party confirmation any signs of extraterrestrial intelligent life despite the vastness of the universe.

There are several possible interpretations of the Great Filter, each with its own implications.

One interpretation is that the Great Filter lies in our own future, meaning that it may be difficult or impossible for human civilization to survive long enough to reach the technological level necessary to make contact with other civilizations.

Another interpretation is that the Great Filter has already been passed by human civilization, meaning that we are the first intelligent, technological civilization to emerge in the universe.

Still another interpretation is that the Great Filter lies in the past, meaning that the conditions necessary for the emergence of intelligent, technological civilizations are rare or non-existent in the universe.

The Great Filter remains a mystery and a subject of much speculation among scientists and philosophers. Its implications are vast and could have significant implications for our understanding of the universe and our place in it.

Today’s Rest of World section is not just about the Great Filter. The above was actually written entirely by AI. Regardless of the poopooing and yawns on Twitter, ChatGPT and other generative AI is a huge milestone. Yes, the technology arguably has been around for a long time, but we are only now starting to see the early commercial use cases of AI that can reliably convince people they are communicating with a human being, AKA passing the Turing Test.

Does AI have something to do with the Great Filter and the Fermi Paradox? If you hardly need me to give the Wrap, what good are people for anyway? What about in 10 years? 1000 years? A million?

Now let me blow your mind. The above was from the Wrap I wrote in 2022.

Three years later, the LLMs are better and can kinda sorta do video now. Really we’ve just seen distribution in the last three years more than anything, which has hollowed out some areas of white collar work and made others more interesting than ever.

This creative destruction process of new technology has so far been a long-term boon to humanity and I’m not convinced that the nature of AI is so fundamentally different than other technologies that the same economic story won’t play out similarly here.

But there will be pain and more of it. Probably, hopefully, for the best.

There’s a story about the free-market economist Milton Friedman going to China to do some work and he saw a slew of workers using shovels for some construction project. When he asked why not use machines instead, the official told him this was intentional to ensure ample jobs were available.

Oh, I see he said. Why not have them use spoons then?

Some directly credit his work there in the 1980’s with China instituting market-based reforms.

Since then the poverty rate in China has gone from 88% to less than 1%.

That’s over a billion souls lifted out of poverty.

He stood 5’ 0’’.

Latest Podcast(s)

In honor of our HR guru Nathan recovering from his motorcycle accident, I released a casual conversation we had earlier this year, mostly about Ukraine and the Middle East.

The nth Venture Apple | Spotify

A Favorite Quote

“Work as if you live in the early days of a better nation.” - Alasdair Gray

Best,

Sam