April 11th, 2025

Happy Friday everyone,

Here is my attempt to share one guy’s answer to the question “what the hell is going on” in about 5 minutes.

The Loop

I hope everyone has enjoyed the nth Venture alumni reporting season thus far. The alumni companies have posted their annual letters and the annual meetings for all but Audily and Merchant Boxes have been held. Please let me know if you had any trouble accessing those.

And the Army goes marching along.

Interesting Articles / Happenings

Finance

2.1 Tape check

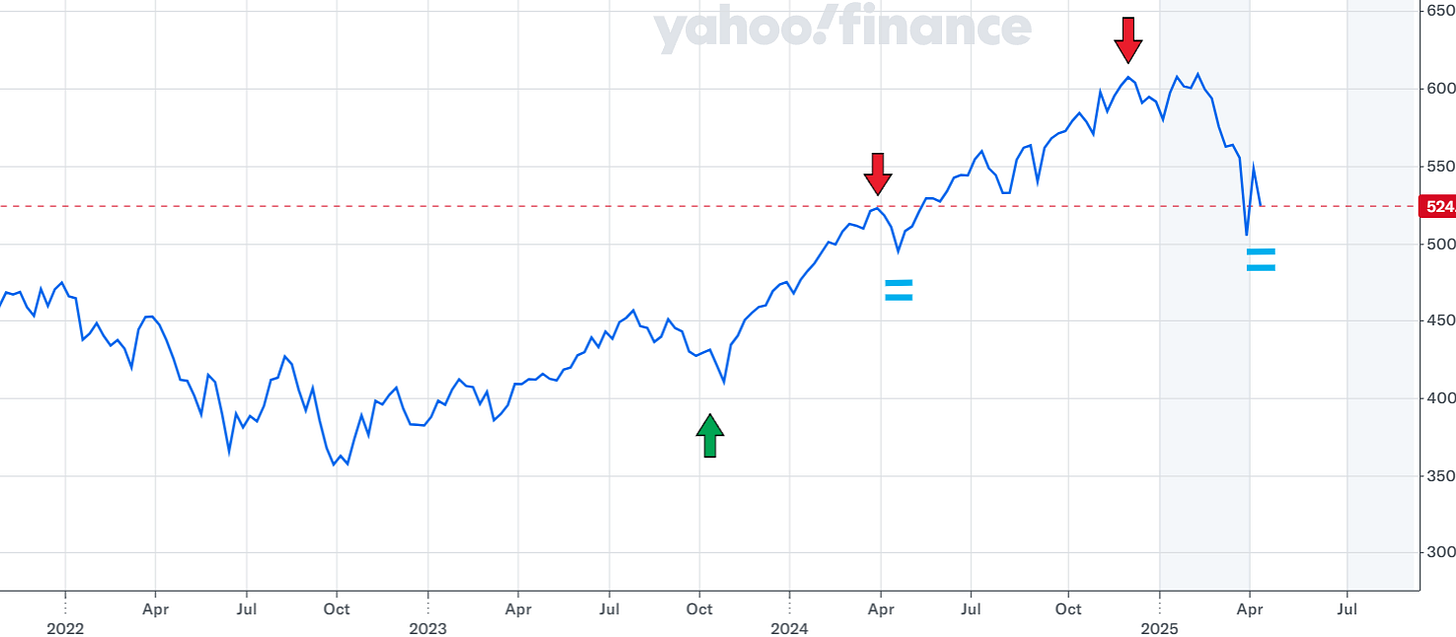

When I made that public prediction of a market downturn a few months ago I quoted Mark Twain: “It is better to be an optimist that is sometimes wrong than a pessimist who is always right.”

It’s a really strange thing to be proven right when predicting a downturn and it feels much better to be right about the upside.

Thankfully for my precious ego, so far if you’re following along with these calls I’ve been sharing you’ve done pretty well.

It’s unclear to me where the market is heading next.

I expect some mean-reversion dip-buying from retail investors but the fundamentals are still elevated compared to where serious value investors would be deploying except in specific instances. There is no general fire sale right now compared to underlying corporate earnings power so I can’t recommend an aggressive buy here, but I would revert to long-term allocations without a specific market prediction (ie. holding an appropriately balanced fund or the broad market like the S&P500 for the long term).

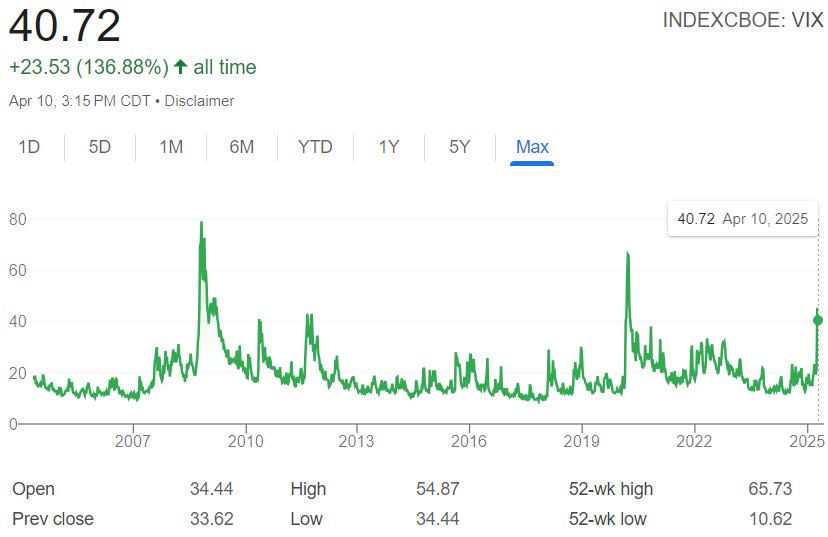

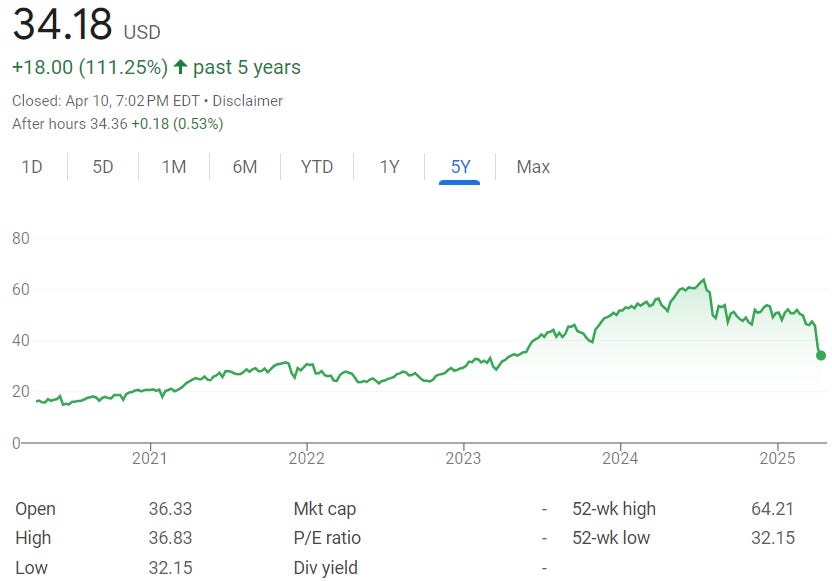

A sophisticated chap with money to burn looking to make a buck though may look to the VIX.

It is extremely elevated and if history is any guide, all crises end.

VIX itself is a complicated calculation of market volatility and not something you can buy, but there are specialty ETFs out there that track the VIX like Barclays’ VXX.

I would not short VXX because you expose yourself to theoretically infinite losses, but a very savvy investor may be interested in buying in-the-money puts on VXX or taking a look at buying (or buying some calls) on the inverse VIX ETF by Invesco, SVXY.

Buyer beware. These are high-risk trades certainly not for the average bear and you have to pay attention to time the exit as well as the entry.

I would classify this as the Dark Arts section at Hogwarts and should almost not even be discussed.

The investment philosophy that reliably wins is investing for the long term across the whole market and forgetting about it.

But hey sometimes when everyone is panicking there’s some money laying around.

2.2 Re-sharing my “Primer on Market Volatility”

Since we’re dealing with some exciting market turbulence, I thought it would be interesting to pull back up an excerpt of an email I sent to folks at nth Venture in 2022 during the first correction we witnessed together.

“Team,

While you will not see me making commentary on the markets often [updated with comment: doing this newsletter has clearly blown that old silence up], it seems appropriate as we witness our first correction together to add some perspective on capital market volatility now and in the future as it relates to our businesses and the firm in general.

We've got the Head of Capital Markets at Nasdaq, a Distinguished Senior Lecturer on Capital Markets at the University of Texas, the former head of Harvard Business Publishing [thank you all for sticking with us gentlemen], and several other financial luminaries on this thread so for many of you this will feel like an ape attempting to explain gravity. Forgive me folks and keep me honest.

“Only when the tide goes out do you discover who's been swimming naked.” -Warren Buffett

We swim in a full on body-suit. [gross]

Capital Markets and the Economy

First, it's important to clarify that capital markets are quite different from the actual economy. By capital markets here I mean the market for securities (ie. stocks and bonds) that are claims on future cash flows. Capital markets are sporadic and volatile by nature for several reasons, but among them is the difficulty in reliably predicting future earnings and the proper discounting of them to account for time and risk premia [this is a pedantic way of saying it’s hard to know how exactly many birds in the bush are worth a bird in the hand]. What appear to be small changes to generally accepted assumptions about growth and interest rates (ie. a fed rate hike [or potential tariff depression on supply and profits]) can have large effects on the market's assessed value of these different streams of earnings. And when people see a significant change "in the market", the herd mentality can set in and create temporary firesales. We're not there yet, but we will live through plenty of them.

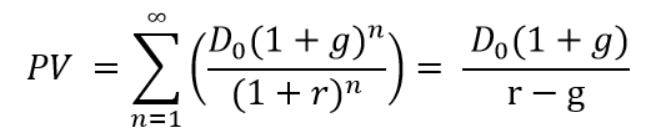

The math behind intrinsic value of stocks especially is very sensitive because you're projecting and discounting a stream of earnings that flows theoretically in perpetuity. Here's the Gordon Growth Model which is the cleanest mathematical explanation of stock prices.

Don't panic! It's actually very simple. The present value (ie. PV) is equal to the sum from now till the cows come home (sigma n from 1 to infinity) of all future dividends (ie. D(1+g)^n) discounted by the relevant cost of capital (ie. (1+r)^n).

The way the calculus works out when you add all those future discounted dividends up is the next dividend payment D1 (or D0(1+g)) discounted by r (cost of capital) minus g (growth rate of future dividends).

The variables r and g are typically single digit percentages and small changes to them can seriously disrupt the equation. We generally know the current and historical r and g for each stream of earnings, but placing a number on them for perpetuity - and betting big money on your assumptions - is a job that will keep Wall Street busy for the foreseeable future. That's not the way it functions in reality but the math here creates the bottom point on the pendulum through which prices will repeatedly swing through and large divergences from it are not sustainable in the long term.

So if you're dealing with challenges to the assumed growth rate for high-flying growth companies based on their recent results and a 0.5% increase in interest rates (ie. cost of capital) and think that these trends are likely to continue for the foreseeable future and the prospects of the company are tied in with their ability to raise money at an attractive valuation to fuel growth then you're dealing with conditions for a serious correction in high-growth, relatively unproven tech stocks. [That was the specific concern in 2022, now we’re dealing with uncertainty primarily regarding artificial price hikes via tariffs which impairs demand which can create negative feedbacks on growth and potentially increase interest rates, but it’s still the same thing: threatened growth, potentially higher rates]

The real economy is quite different. Whether the stock market moves up or down 50%, it's a pretty good bet that Union Pacific and BNSF will continue to deliver America's goods, farms will continue to produce, and the energy base (thanks in particular to the additions of both fracking and renewable sources) will continue to supply obscene amounts of energy. [to burn on crypto]

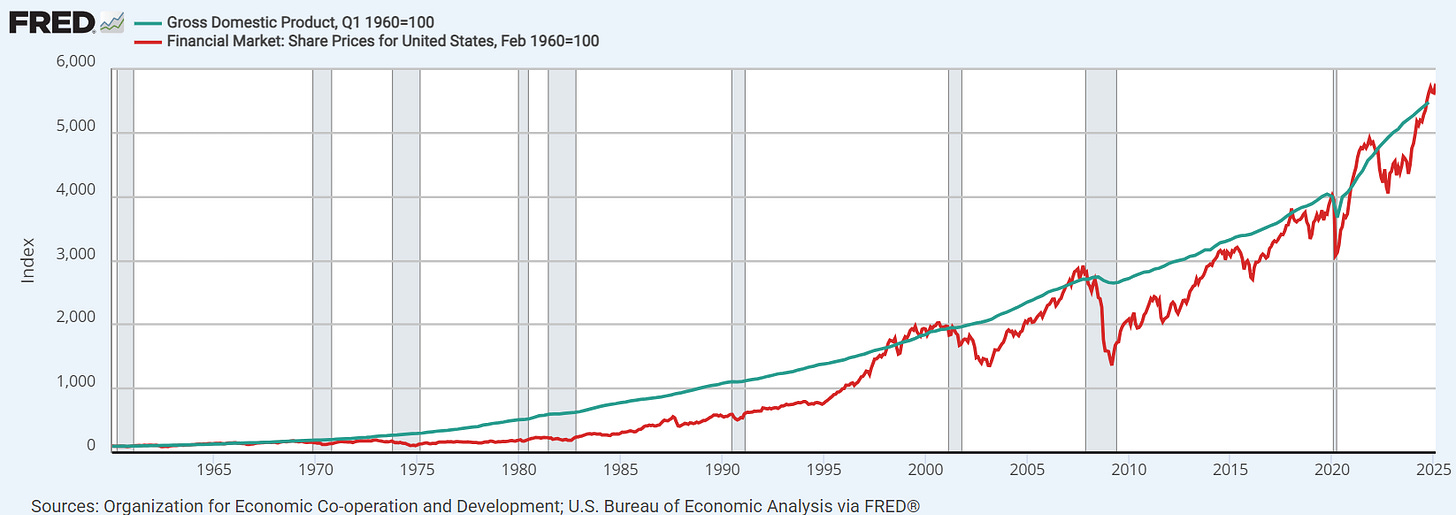

[same graph as 2022, updated with new data]

The chart above shows GDP (real economy) in green and total stock market cap in red. Note that the real economy is drastically more stable and less prone to fits and starts than capital markets. This graph actually doesn't even due it relative justice because they're indexed against themselves in 1960 values rather than to each other so this underplays the true disconnectedness of the relationship.

Major disconnections in the real economy (ie. depressions) are much more brutal and rare, on the order of one per century. With a deeply interconnected global supply chain and modern central banking I personally believe it's more likely we go through a nuclear extinction event in any given year than fall into a major depression, which historically have been primarily continentally-limited events. Sign me up for going out with a bang rather than a whimper, YMMV. [Interestingly, this particular panic poses a direct challenge to my reasoning for predicting 2022 would not lead to a depression. Unlike 2022, when I viewed a depression as not a realistically possible outcome, this time around I believe a depression is a possible outcome, although it is not very likely. We are going through a willful renegotiation of global trade, which regardless of the personalities on any sides, can be resolved by either side at any time. The Nash equilibrium for this case, mutually assured destruction, as I’ve written about before is a very stable paradigm where actors are incentivized to escalate, threaten, and even feign “mad man” but never to willfully destroy both parties.]”

I then went on to describe flows of capital and how we went to enormous pains to generally build businesses at nth Venture that don’t structurally require new capital to exist. Whereas many startups attempt to carry out their blitzscaling growth plans which if halted before “market domination” practically removes all their value, if not destroys the company.

Sustainable growth with an all-weather mindset is the name of the game, or at least our game.

2.3 DOGE & Fiscal Spending

By popular demand in the poll last time, the winner to receive some attention was DOGE & Fiscal Spending.

Good or bad, so far the efforts of DOGE are astonishing, historic, and not nearly enough.

Not by my metrics, but the administration’s.

The stated fiscal goal of the administration as communicated by Messrs. Bessent, Lutnick, and Musk is to achieve a $1 trillion cut off the annual government spending and an addition to tax revenue of $1 trillion through tariffs etc.

Theoretically that would put us into a $200 billion surplus against the 2024 $1.8 trillion deficit if everything goes to plan (somewhat doubtful).

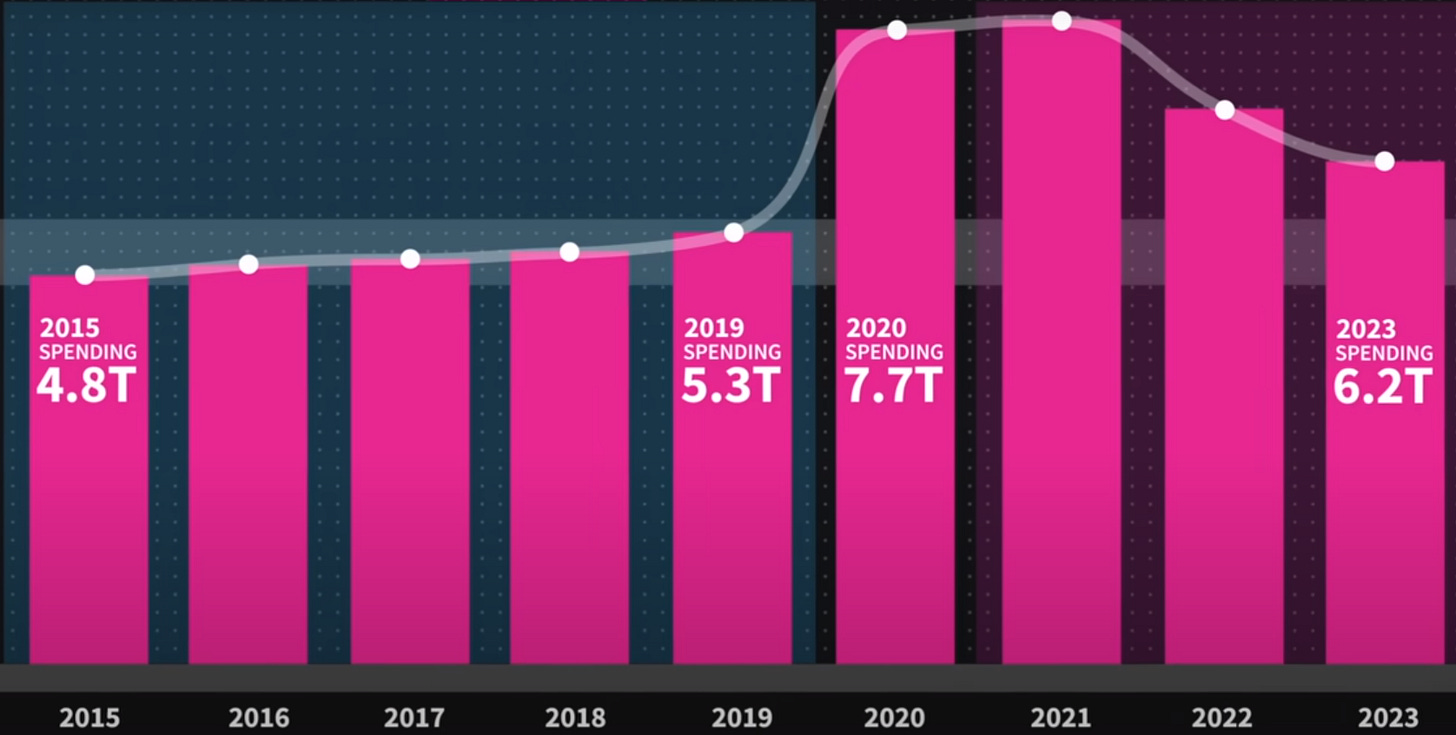

Part of the problem is our spending ballooned during COVID.

Note: this graphic is from usafacts.org where you can watch a video of Steve Balmer explaining the government, which is just wild.

Fiscal stimulus is the right move to prevent a shock from turning into a prolonged depression. Although it was too much, that’s 20/20 hindsight and I don’t begrudge any of the folks at the Fed and Treasury from both administrations who had to act quickly and aggressively.

So can DOGE really find (and actually cut) the $1 trillion target?

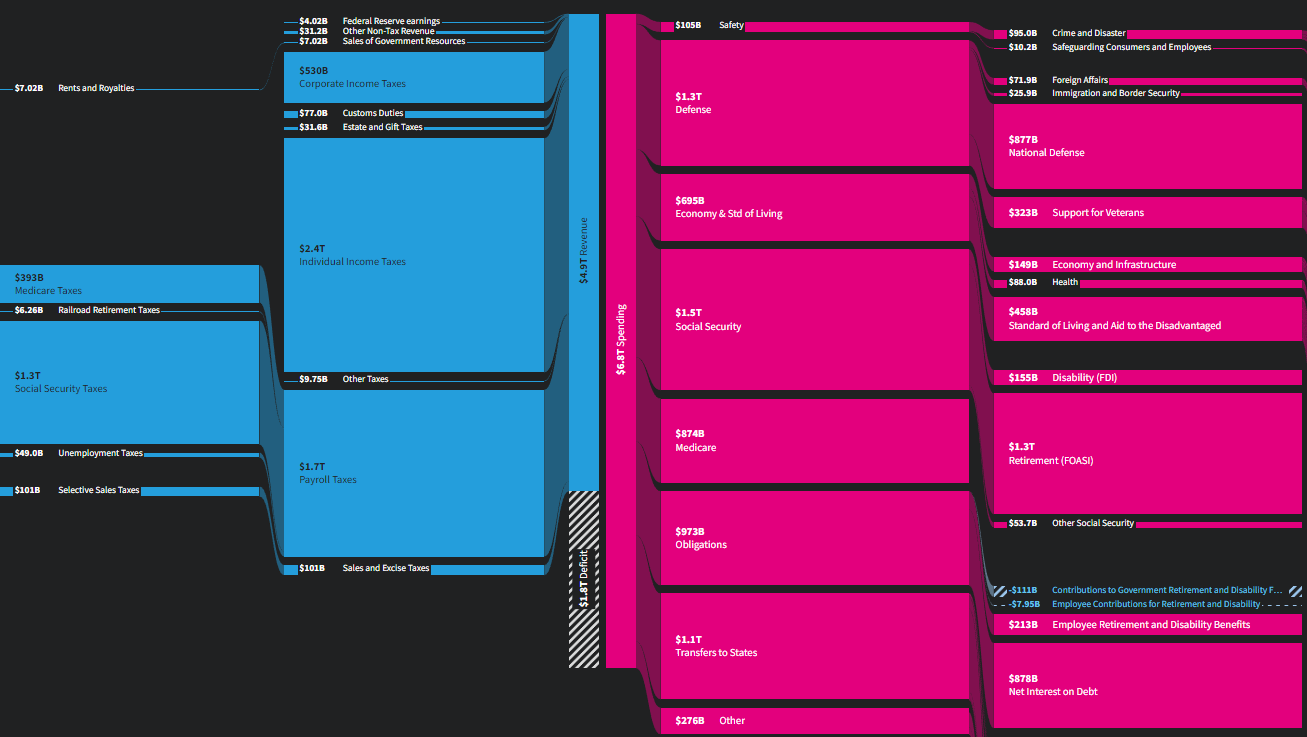

Here’s the 2024 budget:

Find it? Definitely.

Cut it? TBD.

60% of spend goes to “mandatory spending” (which is a ridiculous name) like Medicare, Medicaid, Veteran’s benefits, and Social Security. The only thing different about them is the budget for them is not generally renegotiated every budget cycle in Congress because the eligibility and benefit formulas are set in law. Hardly anyone seems to point out that everything else in the budget is set by law as well. It’s true that there is a moral contract on many of these, especially Social Security, but certainly no less so than the state’s obligation to provide for it’s citizen’s security through effective defense. DOGE has made a variety of promises that it will generally not cut these which I think would be a grave mistake to leave on the table. I digress.

Then you have 13% net interest on debt which is not something budget cuts can address, the bill from prior years is just due.

Being generous on the estimates, that leaves 27% to play with or $1.8 trillion. Defense in 2024 was (we think) $1.3 trillion.

So outside of mandatory, military, and debt you’re left with $500 billion.

So far DOGE has claimed estimated cuts of $150 billion.

This includes a “Combination of asset sales, contract/lease cancellations and renegotiations, fraud and improper payment deletion, grant cancellations, interest savings, programmatic changes, regulatory savings, and workforce reductions.”

That is deeply troubling because although there are clearly efforts at transparency at DOGE, the lack thereof on the total leads you to believe that quite a lot of these savings (assuming they are fully valid) are one-time in nature, especially the asset sales, or that they are taking several years of savings and accelerating it into the current year, especially the contract/lease cancellations.

When you review the “Wall of Receipts” that list the specifically cancelled contracts where the description reads “Displaying 7279 contract terminations totaling ~$25B in savings,” it’s clear that many of them are claiming the full value of multi-year contracts as immediately saved.

That’s fine but that means we are a very long way from saving $1 trillion annually by the stated goal of July 4th.

Without dramatic cuts to the military, entitlement reform, higher taxes, and lower rates our fiscal issues are going to continue, no matter how many lazy government employees get the axe.

That’s just for starters. We need to do all that to break even. The really interesting game that we don’t generally talk about are the principal payments.

Yes the interest on our debt is now about what we spend on the military.

But that does not include the far greater principal payments.

$7.6 trillion of principal is due in the next year. On top of that we need to fund the deficit that we’re surely not going to fill with cuts and tariffs at this clip. That means the Treasury Department needs to find buyers of new US debt about twice the size of our total tax revenue.

Pray for Bessent and thank God for Powell.

Rest of World

Finally we have some good TV. White Lotus Season 3 on HBO is almost as good as Season 2 which is saying a lot.

Latest Podcast(s)

This is not a specific recommendation but if you have Spotify, you may enjoy trying out their Daily Drive playlist which interlaces some upbeat tunes for the morning with quick news segments from NPR, NYT, Daily Wire, etc.

Great for the car or if you’re a homebody like me, the shower.

A Favorite Quote

“If thou desire rest desire not too much.” - Engraved at the U.S. Courthouse in Denver

Wishing you and yours a wonderful weekend.

Best,

Sam